We are pleased to report that we concluded another very strong year in 2022 despite the headwinds we faced with an uncertain economy, difficult inflationary environment and rising interest rates. We adapted quickly to all of these challenges and achieved strong results due to the ongoing support of our customers and the communities we serve.

Following a year in which we surpassed the significant threshold of becoming a $1 billion bank, we are also happy to report that in 2022 we maintained a solid trajectory of growth with assets approaching the $1.1 billion mark. With the loyal support of our customers, dedicated employees and insightful leadership, we deepened our already strong position. Under one bank charter with our Divisions – Collinsville Bank and Litchfield Bancorp – Northwest Community Bank met and exceeded our established goals. As a mutual institution, we have sustained the core values we were founded upon and are distinctly different from regional and national banks. We ended 2022 with healthy earnings and a strong balance sheet.

Serving Our Commercial and Personal Customers

While sustaining our tradition of building relationships with all of our customers, we have increased the ability to provide larger commercial loans and serve a greater number of businesses and consumers. We continue to invest in products, services, technology and training to compete – and offer the best service possible. In 2022, we funded $125 million in commercial loans and $210 million in residential loans, achieving total loan production of $335 million. In addition, we experienced exceptional deposit growth, with total deposits growing by $87 million. 2022 was certainly a robust year in activity!

We are constantly introducing new products, technology updates, security measures and communications. At the same time, we are active participants in many community organizations and events.

Expanding Our Support to Community

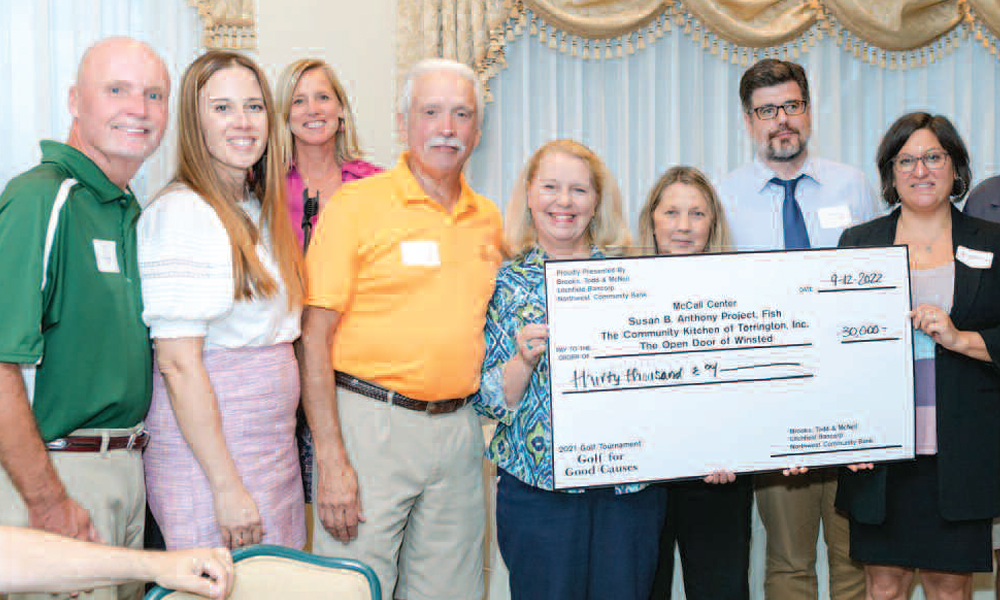

The Northwest Community Bank Foundation was funded and organized on January 1, 2022 as a separate non-profit entity. The Foundation extends the Bank’s ability to contribute to non-profit agencies and organizations working in the communities we serve.

As a mutual savings bank, it is our mission to give back to the communities that we serve. In 2022 the new Foundation awarded 66 grants totaling $425,000. Combined with the $300,000 donated through the Bank’s traditional Corporate Giving Program, the Bank contributed $725,000 to non-profit organizations in our market area in 2022. It continues the Bank’s long history of community involvement and support. The non-profit organizations that received grants in 2022 were thanked in “A Gratitude Gala” in January 2023.

Recognizing the Talent and Dedication in Our Management and Employees

Our most valuable assets are our people. From our newest Universal Banker, through every department, to the managers and executives, we have benefitted from their professionalism and team effort. They are the bedrock of our success. Their efforts have left us well positioned to address the global, domestic, local and personal challenges that affect us all.

Last fall, the Board of Directors embarked on a comprehensive search for the next President & CEO. [President Steve Reilly expressed his plan to retire on September 1, 2023.] Following a thorough process and search, the Bank’s current Executive Vice President & Chief Operating Officer, Maura Malo, has been selected to become President & CEO in September. We could not be more pleased to promote from within and are confident we will experience a smooth, seamless transition of leadership. We are committed to continuing our prudent management, and are most appreciative of our loyal customers and dedicated employees. Our customers are our best ambassadors, and we could not be more grateful for that.

Since the mid 1860s, we have experienced many challenges and changes, and today we are vibrant, growth-oriented and prepared to address the times ahead.

Sincerely,

| Stephen P. Reilly President & CEO  |

William J. Shea II Chairman  |